What is a Durable Power of Attorney in Washington State?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. This authority remains in effect even if the principal becomes incapacitated. The DPOA can cover various areas, including financial matters, healthcare decisions, and other personal affairs.

How do I create a Durable Power of Attorney in Washington?

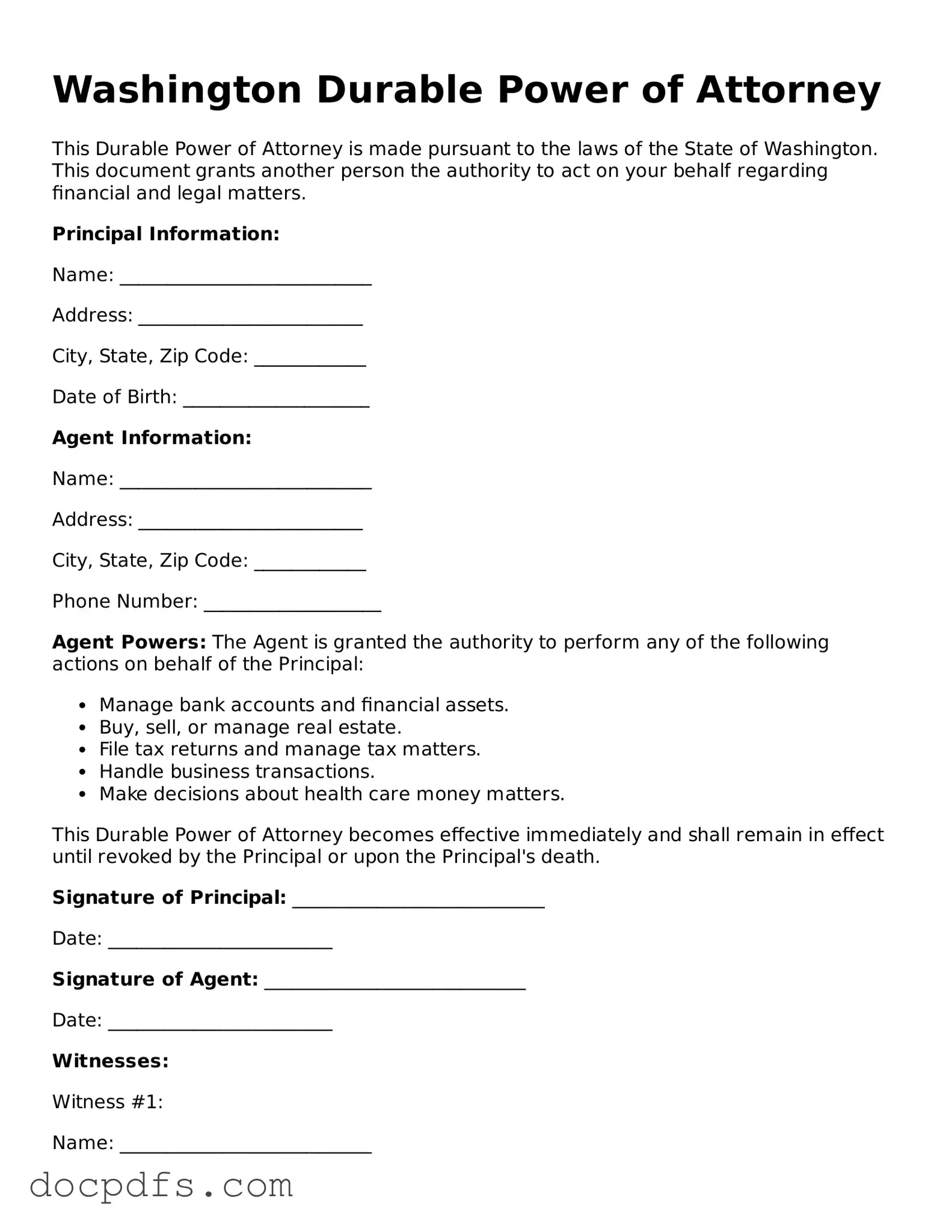

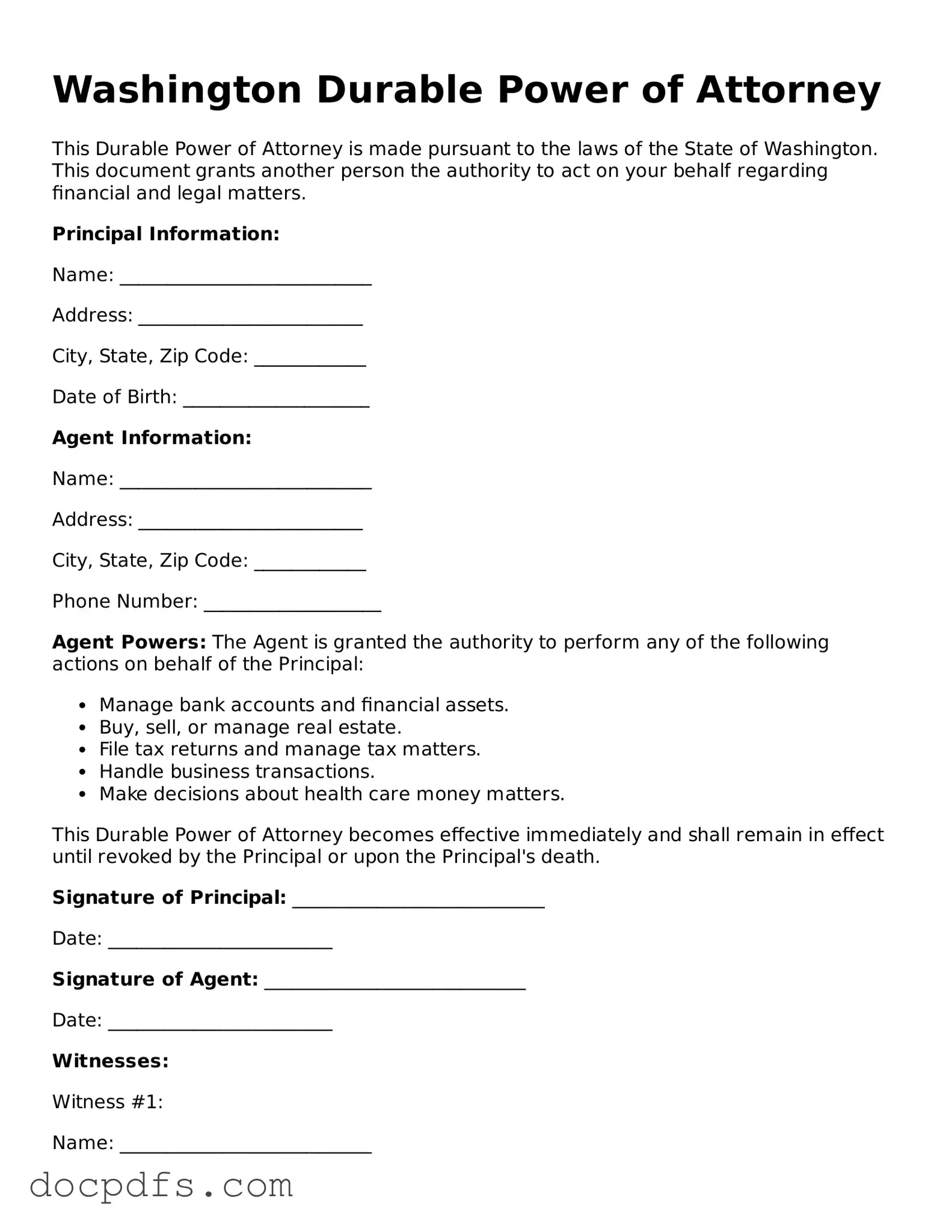

To create a DPOA in Washington, follow these steps:

-

Choose a trusted person as your agent.

-

Obtain a Durable Power of Attorney form. You can find this form online or through legal resources.

-

Fill out the form, specifying the powers you wish to grant to your agent.

-

Sign the document in the presence of a notary public or two witnesses, as required by Washington law.

What powers can I grant to my agent?

You can grant a wide range of powers to your agent, including:

-

Managing bank accounts and investments

-

Paying bills and taxes

-

Making healthcare decisions

-

Buying or selling property

-

Handling legal matters

It is essential to be specific about the powers you wish to include in the document to avoid confusion later on.

Can I limit the powers of my agent?

Yes, you can limit the powers of your agent in the DPOA. You might specify that your agent can only manage certain assets or make decisions in specific situations. Clearly outlining these limitations in the document is crucial to ensure your intentions are understood and followed.

What happens if I become incapacitated?

If you become incapacitated, your Durable Power of Attorney remains in effect. Your agent can then step in and make decisions on your behalf, as outlined in the document. This is one of the main benefits of a DPOA, as it allows for continuity in managing your affairs during times when you cannot do so yourself.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your DPOA at any time, as long as you are still mentally competent. To revoke, you should create a written notice stating your intent to revoke the previous DPOA. It's advisable to notify your agent and any institutions that may have a copy of the original document.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer to create a DPOA in Washington, consulting with one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. If your situation is complex, legal advice may be particularly valuable.

A Durable Power of Attorney can be set up to take effect immediately upon signing or to become effective only upon your incapacity. If you choose the latter, you should include specific language in the document to clarify this condition. Understanding when the powers activate is essential for both you and your agent.

What should I do with the Durable Power of Attorney after it is signed?

After signing your DPOA, keep the original document in a safe place. Consider providing copies to your agent, healthcare providers, and any financial institutions where you have accounts. Ensuring that key people have access to the document can help avoid complications when it needs to be used.