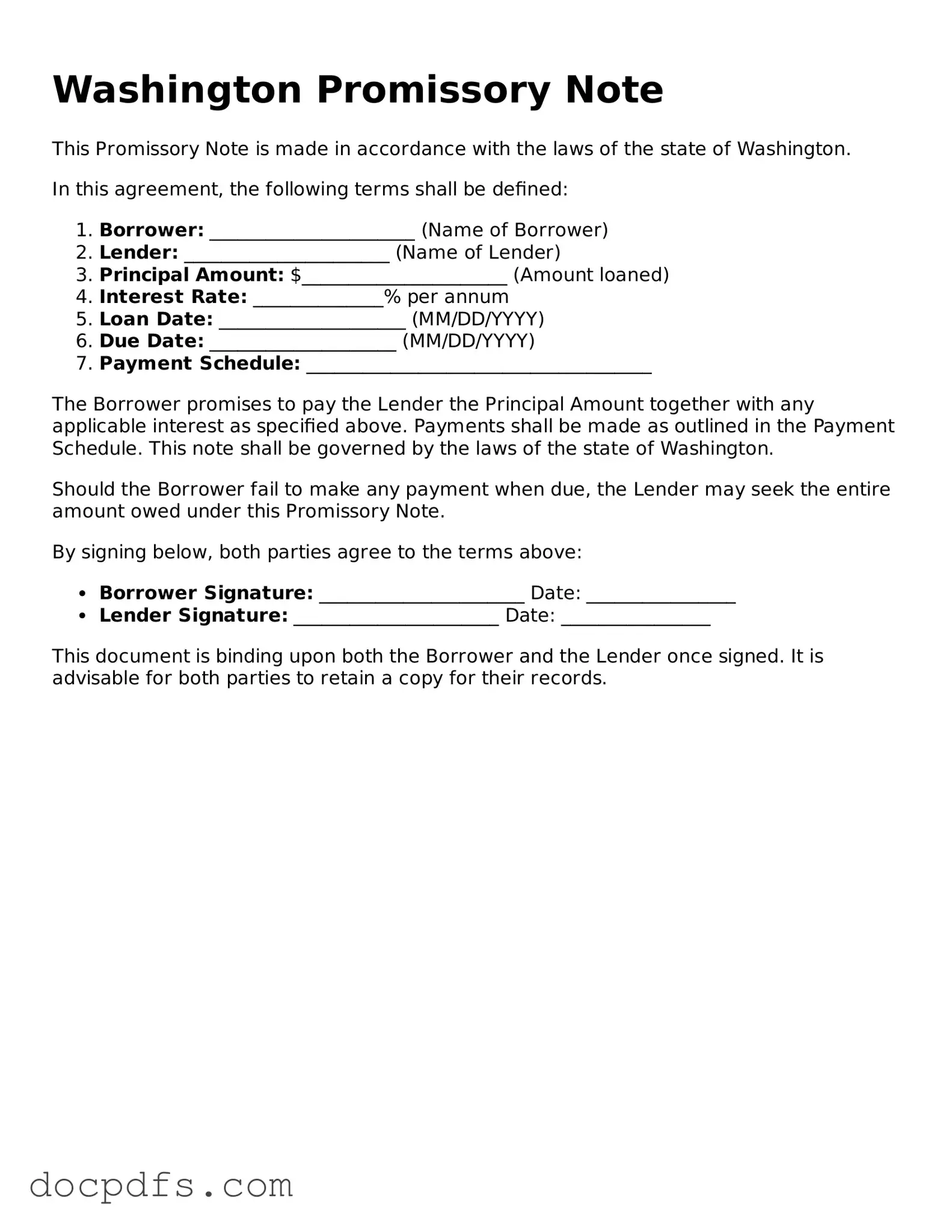

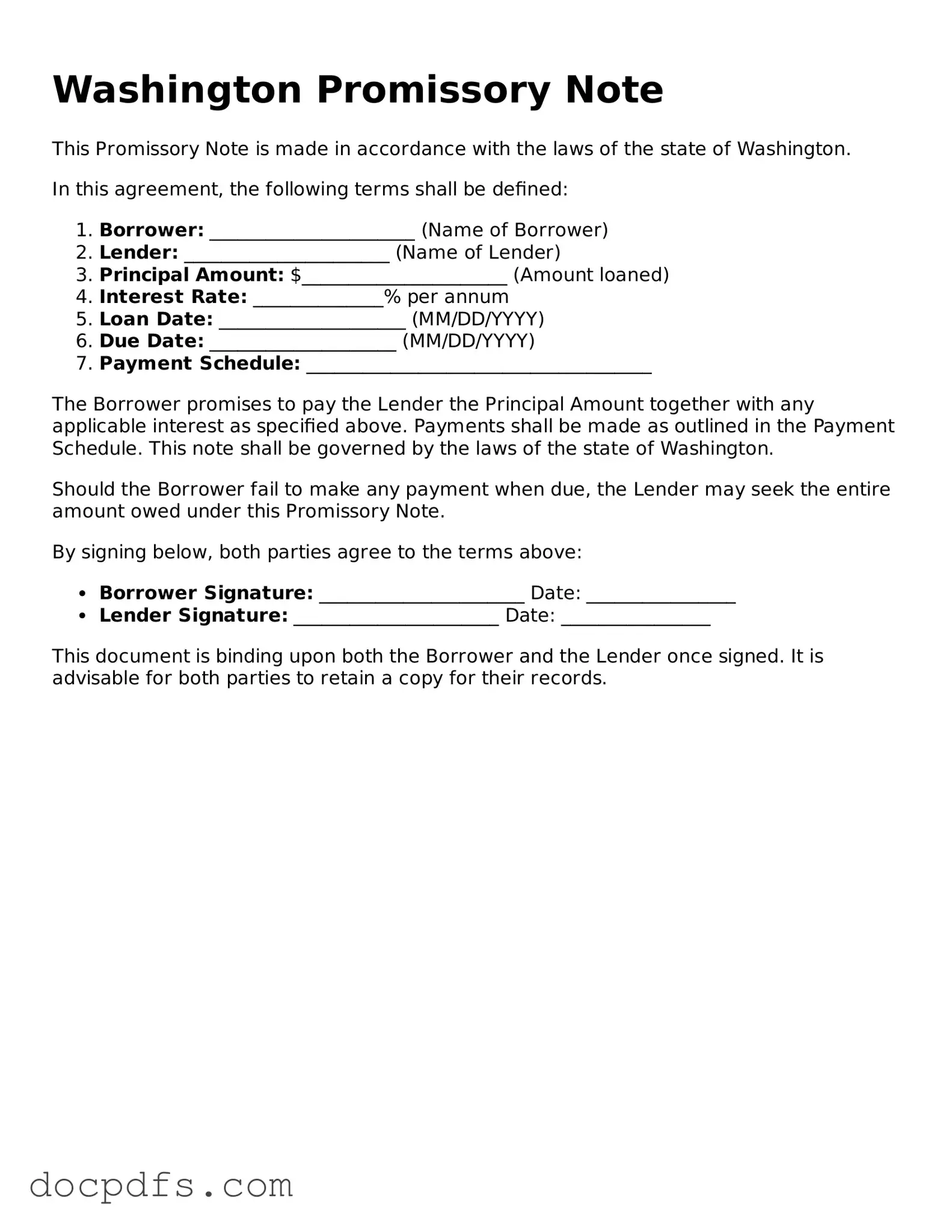

Free Washington Promissory Note Form

A Washington Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a designated time. This form serves as a legally binding document that outlines the terms of the loan, including the interest rate and repayment schedule. Understanding the details of this form is essential for both lenders and borrowers to ensure clarity and compliance with state laws.

Open Promissory Note Editor Now

Free Washington Promissory Note Form

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

⇓ Promissory Note

Finish this form the fast way

Complete Promissory Note online with a smooth editing experience.