What is a Washington Quitclaim Deed?

A Washington Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without guaranteeing that the title is clear. This means the grantor (the person transferring the property) does not promise that they have a good title to the property. Instead, they simply convey whatever interest they may have in the property at the time of the transfer.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in several situations, including:

-

Transferring property between family members.

-

Clearing up title issues.

-

Transferring property into a trust.

-

Divorce settlements, where one spouse may transfer their interest to the other.

It is important to note that a Quitclaim Deed does not provide any warranties regarding the property title, so it is advisable to use it when the parties involved trust each other.

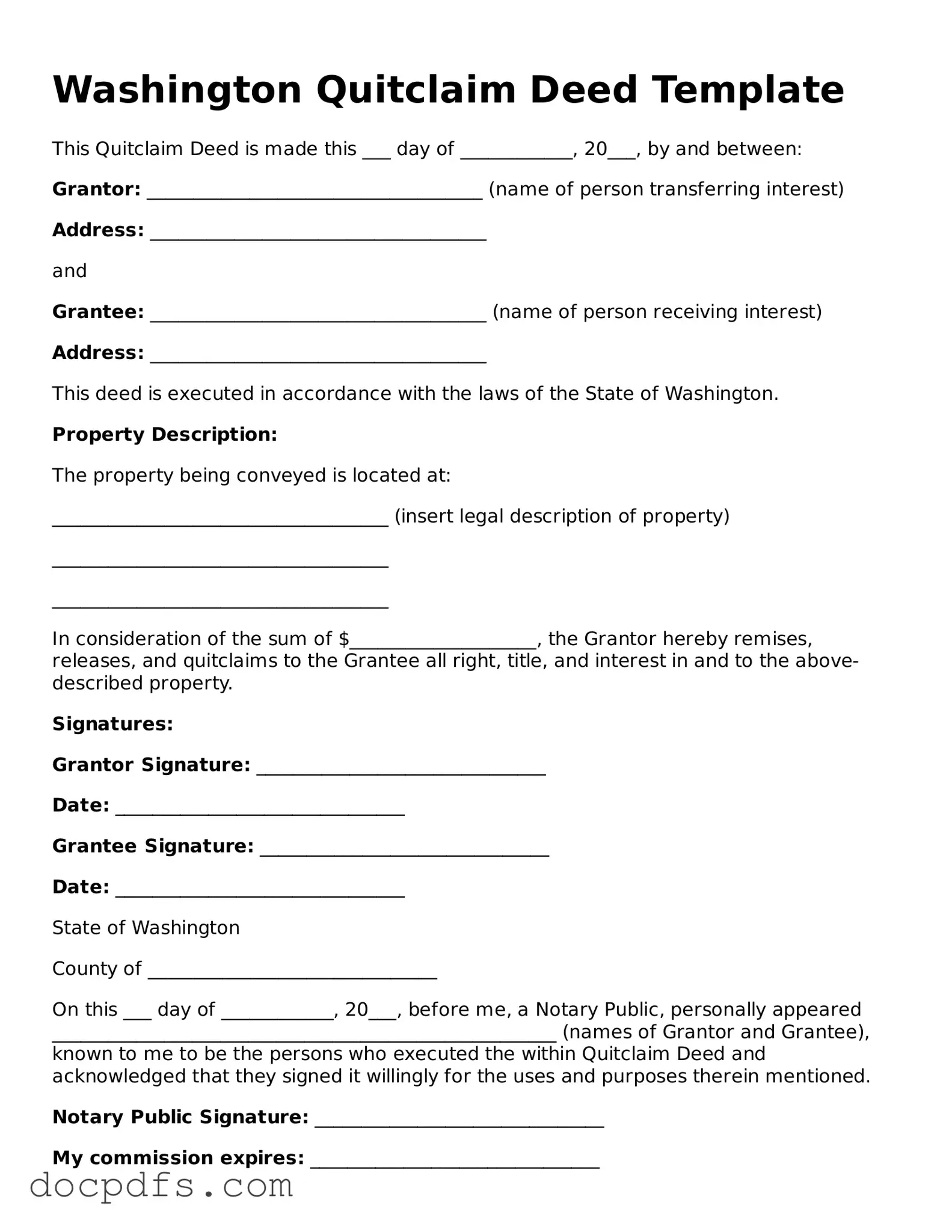

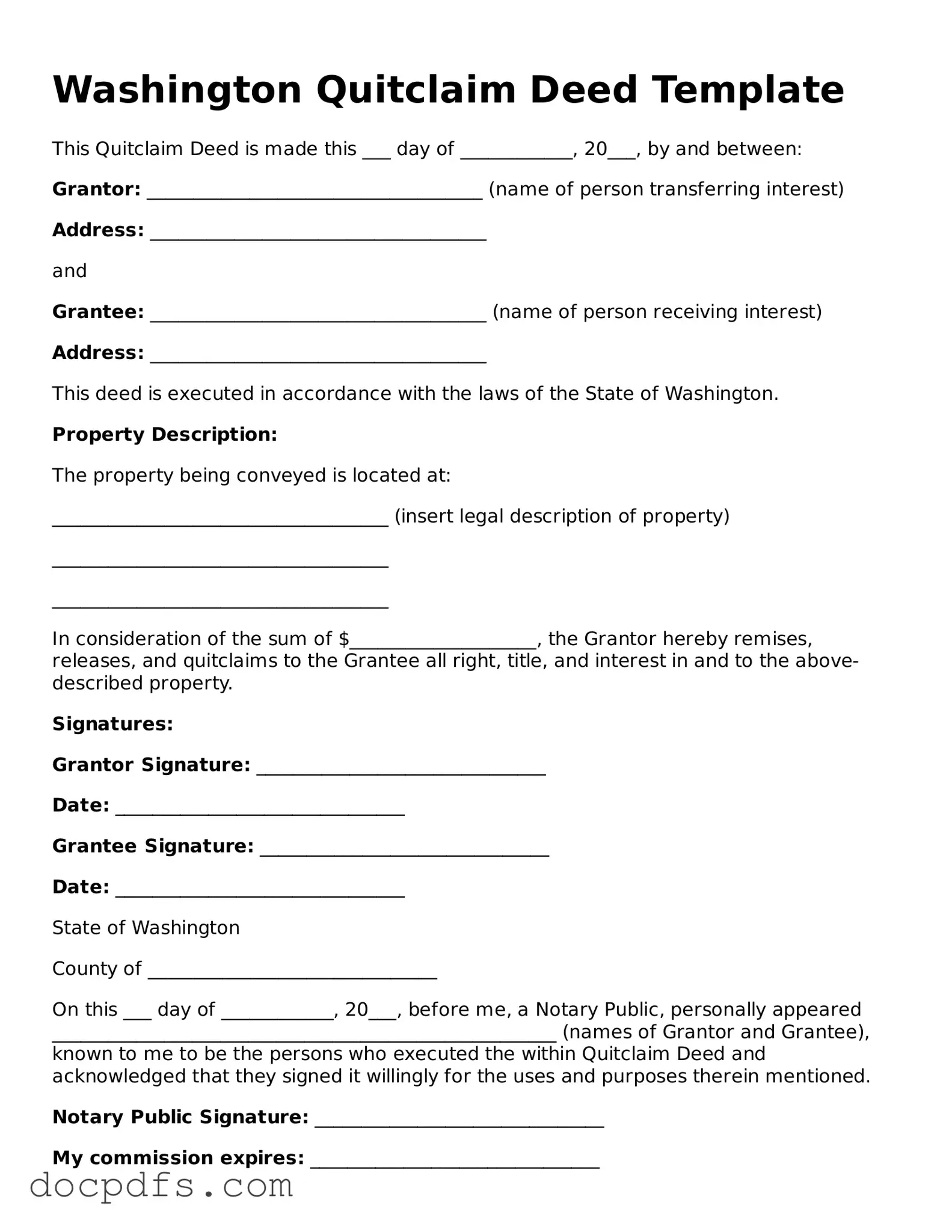

How do I complete a Quitclaim Deed in Washington?

Completing a Quitclaim Deed involves several steps:

-

Obtain a Quitclaim Deed form, which can be found online or at legal stationery stores.

-

Fill out the form with the required information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer.

-

Sign the document in front of a notary public. The notary will verify the identities of the signers and witness the signing.

-

Record the completed Quitclaim Deed with the county auditor’s office where the property is located. This step is crucial to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees associated with recording a Quitclaim Deed in Washington. These fees can vary by county, so it is advisable to check with the local county auditor's office for the exact amount. Additionally, there may be notary fees if you require a notary public to witness the signing of the document.

What are the tax implications of using a Quitclaim Deed?

When a Quitclaim Deed is executed, it may have tax implications. Generally, transferring property via a Quitclaim Deed is not considered a taxable event if it occurs between family members. However, if the transfer involves a sale or exchange, capital gains tax may apply. It is advisable to consult a tax professional to understand the specific tax consequences related to your situation.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be unilaterally revoked. The transfer of property is considered final. However, if both parties agree, they can execute a new deed to reverse the transaction. Legal advice may be necessary to navigate any disputes regarding the deed.