What is a Washington Tractor Bill of Sale?

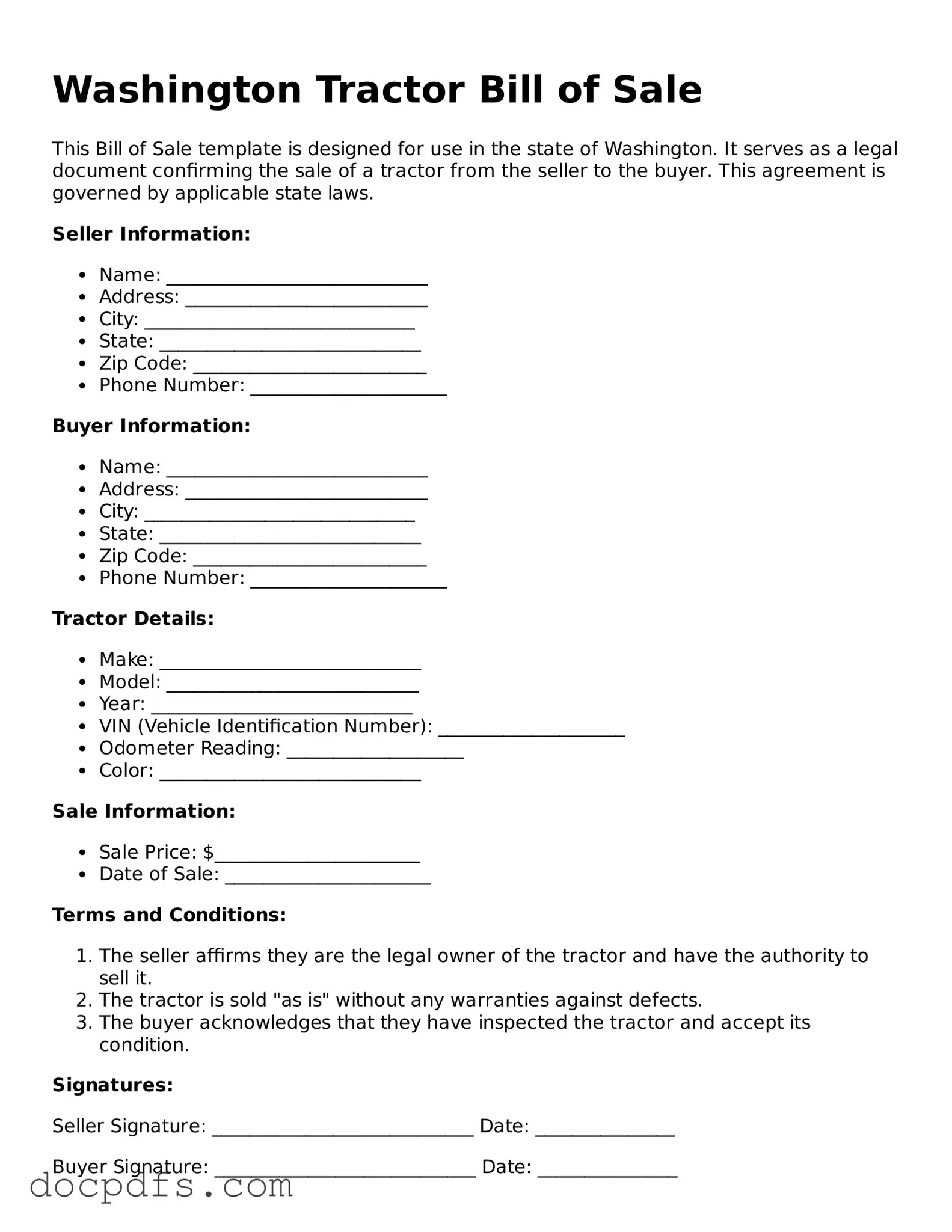

A Washington Tractor Bill of Sale is a legal document that records the sale of a tractor between a seller and a buyer. It serves as proof of the transaction and outlines essential details such as the purchase price, date of sale, and identification of the tractor. This document is crucial for both parties to ensure a clear understanding of the sale terms.

Why is a Bill of Sale important?

A Bill of Sale is important for several reasons:

-

It provides legal protection for both the buyer and seller.

-

It establishes ownership of the tractor.

-

It can be used for registration and titling purposes.

-

It serves as a record for tax purposes.

The Washington Tractor Bill of Sale should include the following information:

-

The names and addresses of both the seller and buyer.

-

The date of the sale.

-

A description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

-

The purchase price of the tractor.

-

Signatures of both parties.

Do I need to notarize the Bill of Sale?

Notarization is not required for a Bill of Sale in Washington State. However, having it notarized can provide an additional layer of protection and may be beneficial in case of disputes. It verifies the identities of the parties involved and confirms that the signatures are authentic.

While you can use a generic Bill of Sale form, it is advisable to use a specific Washington Tractor Bill of Sale to ensure that all relevant state requirements are met. A tailored form will better capture the necessary details specific to the sale of agricultural machinery.

Is there a fee for filing a Bill of Sale?

There is no fee for filing a Bill of Sale in Washington State, as it is not required to be filed with a government agency. However, there may be fees associated with registering the tractor or obtaining a title, which are separate from the Bill of Sale process.

What should I do with the Bill of Sale after the transaction?

After the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer may need it for registration and titling purposes, while the seller should retain it as proof of the sale in case any issues arise in the future.

What if the tractor has a lien on it?

If the tractor has a lien, it is essential to disclose this information in the Bill of Sale. The seller should ensure that the lien is satisfied before the sale or inform the buyer of the existing lien. Failure to do so could lead to legal complications for both parties.

You can obtain a Washington Tractor Bill of Sale form from various sources. Many legal websites offer downloadable templates. Additionally, local agricultural associations or equipment dealers may provide forms. Ensure that any form you use complies with Washington State laws.