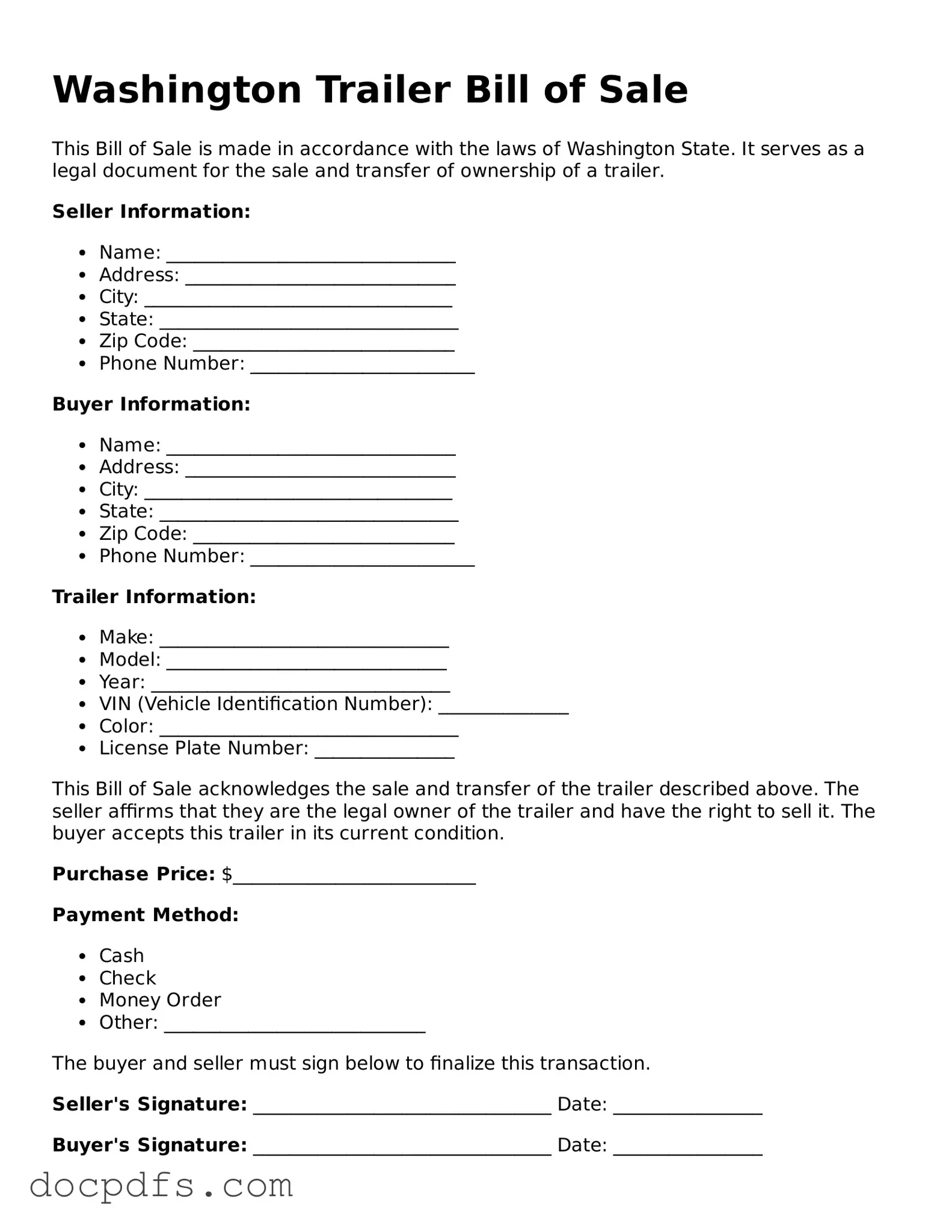

The Washington Trailer Bill of Sale form is a legal document that records the sale of a trailer. It serves as proof of the transaction between the buyer and the seller. This form typically includes details about the trailer, such as its make, model, year, and Vehicle Identification Number (VIN), along with the names and signatures of both parties involved in the sale.

Why do I need a Bill of Sale for my trailer?

A Bill of Sale is important for several reasons. It provides legal evidence of the transaction, which can help protect both the buyer and seller. For the buyer, it confirms ownership and may be required for registration. For the seller, it offers proof that they no longer own the trailer, which can be important for liability reasons.

The form should include the following information:

-

Full names and addresses of both the buyer and the seller

-

Description of the trailer, including make, model, year, and VIN

-

Purchase price of the trailer

-

Date of the sale

-

Signatures of both parties

Is the Bill of Sale required to register my trailer?

Yes, the Bill of Sale is typically required when registering a trailer in Washington State. It provides proof of ownership and helps the Department of Licensing process the registration accurately. Always check with local authorities to confirm any additional requirements.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it contains all the necessary information. However, using a standard form can help ensure that you include all required details and comply with state laws. Many online resources offer templates specifically for Washington State.

Do I need to have the Bill of Sale notarized?

In Washington, notarization is not generally required for a Bill of Sale for a trailer. However, having the document notarized can add an extra layer of protection and authenticity, especially if there are disputes in the future.

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it can be challenging to prove ownership. It is advisable to keep multiple copies in a safe place. If you cannot locate the original, you may need to contact the seller for a replacement or consult local authorities for guidance on how to proceed.

Can I use the Bill of Sale for tax purposes?

Yes, the Bill of Sale can be used for tax purposes. It serves as proof of the purchase price and can be helpful when calculating any applicable sales tax. Keep a copy for your records, as it may be required during tax season or if you decide to sell the trailer in the future.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a signed copy for their records. The buyer should then take the Bill of Sale to the Department of Licensing to register the trailer. It is also a good idea to notify your insurance company about the change in ownership.