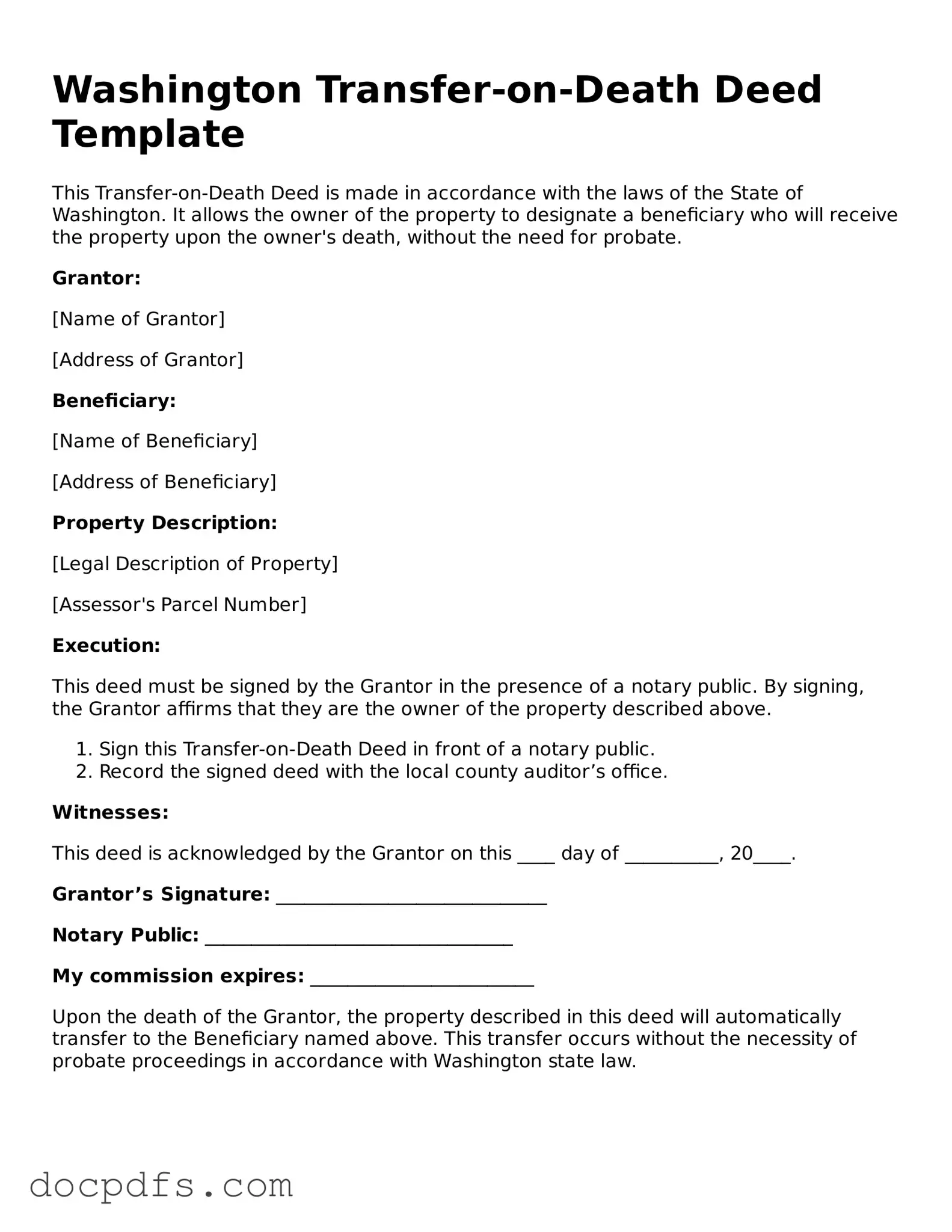

What is a Transfer-on-Death Deed in Washington?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows property owners in Washington State to designate one or more beneficiaries to receive their real estate upon their death. This type of deed enables the property to transfer outside of probate, simplifying the process for heirs.

Who can create a Transfer-on-Death Deed?

Any individual who owns real property in Washington can create a Transfer-on-Death Deed. This includes sole owners, joint owners, or tenants in common. However, it’s important to ensure that the deed is executed properly to be valid.

How do I create a Transfer-on-Death Deed?

To create a TOD deed, follow these steps:

-

Obtain the appropriate form from a reliable source, such as a legal website or local government office.

-

Fill out the form, providing details about the property and the beneficiaries.

-

Sign the deed in the presence of a notary public.

-

Record the signed deed with the county auditor’s office where the property is located.

Are there any restrictions on who can be a beneficiary?

While there are no specific restrictions on who can be named as a beneficiary, it is advisable to choose individuals who are capable of managing the property. Common choices include family members or trusted friends. Additionally, a beneficiary must be a living person or a legal entity, such as a trust.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you need to create a new deed or a revocation document. It’s important to record any changes with the county auditor to ensure that your wishes are accurately reflected in public records.

What happens if a beneficiary predeceases me?

If a beneficiary named in your Transfer-on-Death Deed passes away before you do, the property will not automatically transfer to that beneficiary’s heirs. Instead, the share intended for the deceased beneficiary will typically be divided among the remaining beneficiaries, unless otherwise specified in the deed.

Is there a cost associated with creating a Transfer-on-Death Deed?

While creating a Transfer-on-Death Deed itself may not incur significant costs, you should consider potential expenses such as notary fees and recording fees at the county auditor’s office. These fees can vary by location, so it’s wise to check with your local office for specific amounts.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to hire an attorney to create a Transfer-on-Death Deed, consulting with one can be beneficial. An attorney can help ensure that the deed is filled out correctly and that it aligns with your overall estate planning goals. This guidance can prevent potential disputes or issues down the line.